Simple, obvious, and unobstructive: minimize the value-minus of taxes

At a recent speech, Governor Palin said that there is no value-added in taxes. I almost put that quote alone on my site, but pulled it down before publishing it, because a statement like that can’t stand alone.

Obviously, if we’re going to have a government, that government needs some form of funding, even if it’s just to pay for the domain name. And I can’t see government funding becoming voluntary. “Bake sale for bombs” has an intrinsic appeal, but it will never happen.

So some form of taxes are necessary. But we must never forget that taxes are not themselves of value. They are a compromise between freedom and good intentions. Taxes should not exist for their own sake; today, too often, they do. We forget that the things we get from government came from our own wealth. And that every tax levied is an economic opportunity lost. Money spent on taxes does not produce or create productive jobs. The very act of taxing obstructs job creation, economic growth, and opportunity.

Taxes should be simple, they should be obvious, and they should be unobstructive.

Taxes should be simple

Taxes should be simple because when they’re complex they do two very bad things. The most obvious is that they make it more expensive to pay your taxes. I have an incredibly simple income stream; I own no property, hold only one job, am unmarried, and have all of my savings in one bank. I don’t even itemize. Even then, I have to buy tax software and spend hours answering questions that I mostly just hope I’m understanding correctly.

Undoubtedly I’m paying too much tax by doing it this way. But even overpaying can cause trouble. Every once in a while I’ll pull in $300 a year on Amazon sales. My expenses far outweigh that: the cost of running hoboes.com alone exceeds that. But it still isn’t worth it to spend hours figuring out how to deduct them correctly. So I just report the full amount. A few years ago, I received a letter from the IRS asking why I wasn’t paying quarterly social security taxes on this money. So I still had to spend the time—after my heart returned to my chest—writing a letter explaining that I’m not really making that much money, I just don’t want to deal with reducing it. And then hoping that I didn’t hear from them again afterwards (which I haven’t, so far).

Tax law complexity also adds to costs on the other end: the IRS spends a lot of money processing taxes, and of course that money reduces the amount of money we can use on what taxes are supposed to pay for.

Americans spend $250,000,000,000 to $300,000,000,000 each year just to prepare and file taxes. The tax preparation industry is so big, it can successfully lobby the government not to simplify taxes and keep the IRS from offering free online submission.

The GAO estimates that overall, it costs 20% of taxes to pay for taxes. That’s crazy inefficient. Think of what we could do with an extra 20% either in taxes or in the economy!

Simplifying taxes saves time and money throughout the tax chain. Both individuals and businesses expend too much time and money complying with our complex tax system—time and money they could use to create more products, buy more products, or hire more people. Removing tax complexity doesn’t just make individual lives easier, it makes our economy stronger by freeing our businesses to focus on their actual business. They can hire more people within their industry instead of having to hire more (expensive) tax compliance specialists.

Taxes should be obvious

It should be obvious when we’re paying taxes and how they’re being paid. Invisible taxes are easy to abuse, because the products of those taxes, no matter how inefficient, come to look like they’re free. The more invisible a tax is, the less incentive there is to keep the tax low and to use the tax well.

Taxes would be a lot lower right now, and tax money better spent, if everyone wrote a check for the full amount at the end of every month, rather than having it invisibly removed from their paycheck. We all know people who think that their tax rebate is free money.

Simplicity shouldn’t make taxes less obvious. For example, the simplest tax would be to have no levied taxes at all, and just let the government print more money when it needs more money. But because no one is actually paying this tax directly, there will be no limit to how much the government will spend—and then inflation will drive the prices of everything through the roof. A tax like this would almost certainly destroy any democracy. The cry for more “free” services will never stop when no one thinks they’re paying for it.

Similarly, as I wrote in Tax individuals, not organizations, sales taxes are better than business taxes. Business taxes are just like sales taxes except that they’re invisible. They still raise the price of the product, but they hide which part of that price is taxes.

Taxes should not obstruct

It isn’t contradictory to say that taxes should be obvious but unobstructive. Both relate to each other. Taxes should not get in the way of creating jobs, growing the economy, building a business, building a career, or saving for the future.

Taxes should not require lots of paperwork. They should not require that every business have a dedicated tax compliance department; this makes it harder for startups to compete with established businesses. Less competition means higher prices, a more fragile economy, and reduced innovation. Taxes should not be so complex that it is easy for individuals (and businesses) to accidentally break the law. They should not be so complex that large businesses easily lobby for rules that cripple their competitors.

Individuals should never make less money after taxes just because their income rose or they put away savings. That can only encourage cheating. The first year I started saving, the interest on my savings—about $5 or $10—increased my taxes by double that. Guess what? I cheated. Because I wasn’t alone, laws were created to keep us from cheating in the future, requiring every tiny bit of income to be reported and stored in a central database. Obstructive taxes create obstructive laws.

Taxes should also not grant government agencies legislative power. Tax authority shouldn’t be an authority to limit free speech or tell a company how to run its business.

What about low taxes?

This doesn’t say that taxes must be low. If taxes are simple and obvious, and people choose to support high taxes anyway, well, they’ve clearly chosen to do so. And as long as they’re simple and unobstructive, the taxes, high or low, will go more to what they’re collected for and less to the act of collecting them. Today, though, taxes are so insidious that few people know where they all are and how many they’re paying. And they’re so complex that at least 20% of the money spent on taxes don’t go to the taxes themselves, but are spent in the preparation and processing of taxes.

We pay taxes for the privilege of paying taxes.

What about low spending?

Nor does it say that spending must be low. But if taxes are obvious, and we still choose to spend that money, then fine. We know what’s being spent. We shouldn’t sneak money away from people: we should be proud of whatever programs we’re spending it on.

Government spending shouldn’t obstruct people and businesses from doing their job any more than taxes should. The government shouldn’t, through its spending, become the plum customer in an industry, because that industry will then ignore smaller customers—such as you and me and the places we work for. The obvious example is health care. If the health care industry decides that they can make more money catering to government bureaucrats than to us as patients, we’re screwed. Imagine all the problems you’ve had with your employer-based health care and multiply it by thousands.

High government spending in any one industry sucks up economic viability just like fire sucks up oxygen. It destroys it, or at least locks it away to where it can’t be reached.

Taxes never add value. They increase corruption, depress the economy, and reduce jobs. They are sometimes useful, sometimes even necessary, but we must never forget that they are a compromise between some thing that we want to force everyone to contribute to and freedom.

- January 11, 2017: Consumption vs. Income vs. Sales

-

People who know more than I do keep calling for replacing the income tax with a “consumption” tax.

As if they’re expecting the consumer to calculate it and send it in at the end of the year… if it could be done that way, it would alleviate a lot of my concerns about the use of sales taxes instead of income taxes.

In Is it better to tax incomes or purchases? I wrote that “Sales taxes are not sales taxes, they are purchase taxes” because they are paid for by the purchaser, not the seller. So I really don’t have a problem calling them “consumption” taxes despite the joke. And I am generally well-disposed toward replacing the income tax with a consumption tax, because I am generally better-disposed to discourage consumption than to discourage income. What is taxed is discouraged, and if something has to be discouraged better consuming than creating. But the more I think about the long-term effects of purchase taxes vs. income taxes, the less well-disposed I am to making the change.

It is reasonably possible for the average person1 to know what their income is, and so, under a simple income tax, calculate what their income tax is. That makes it reasonably possible to not force employers to become an enforcement arm of the federal government, calculating, collecting, and remitting taxes. Getting third parties out of paying taxes would also make it harder to hide some taxes, such as half of the social security tax that employers take out of their employees’ pay and pretend it never existed.

It doesn’t seem reasonably possible for the average person to know what their consumption is, and so to calculate their own consumption taxes. This means that sellers will always have to be forced by the federal government to calculate, collect, and remit such taxes. Consumption taxes will always conceptually be sales taxes.2 Politicians will easily be able to hide some taxes that they would rather remain hidden. And so consumption taxes will always be a damper on new business creation—and new job creation.

- April 20, 2016: Is it better to tax incomes or purchases?

-

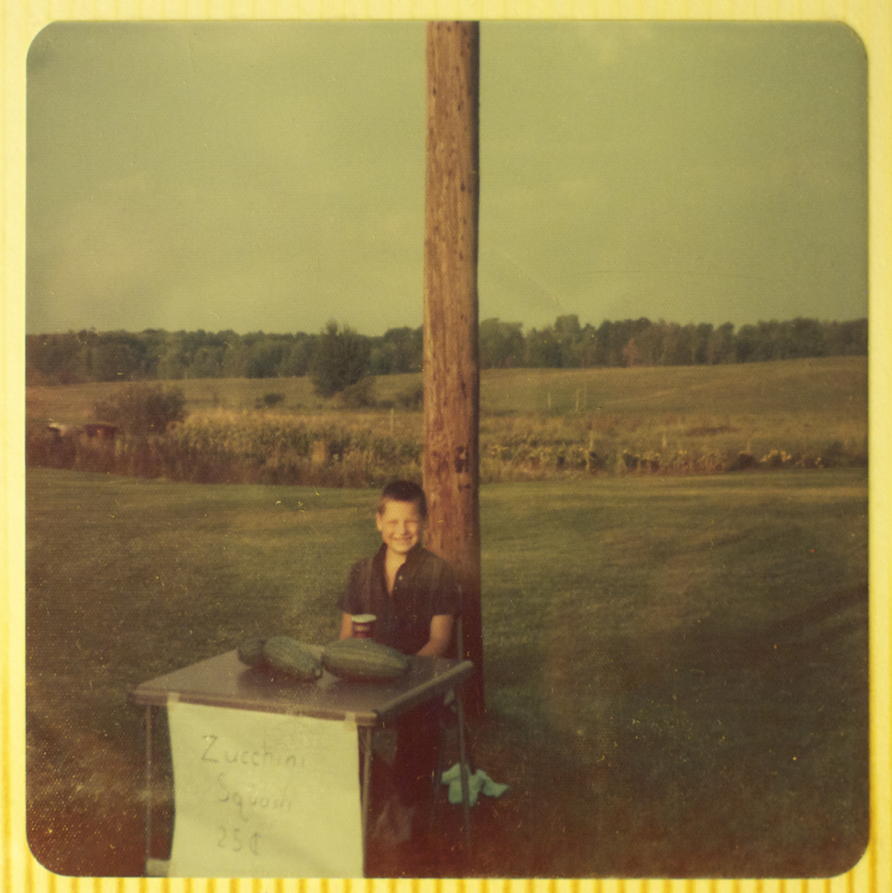

Should I have been collecting sales tax on these zucchini? How does the fact that we paid sales tax on the seeds factor in? What records do I have to keep to prove it? What happens when a seven-year-old fails to keep those records?

Every election season, tax simplification becomes popular. Once the election is over, it disappears.1 This year, some sort of federal sales tax is being promoted by a lot of people as a solution. Sales taxes, though, don’t seem to fulfill my own tax requirements of simple, obvious, and unobstructive when compared to income taxes.

The big problem I see with sales taxes is that they are paid for by consumers but not levied upon them. Like corporate taxes, sales taxes are not paid by businesses but by consumers and by employees. The title is bullshit, and meant to misdirect what sales taxes really are. Sales taxes are not sales taxes, they are purchase taxes. The seller is not taxed when they sell you something. You are taxed when you purchase something. It’s just that for political and logistical reasons governments prefer to rope the seller into collecting that tax.2

Sales taxes are also too complex to be levied against the person paying them. Unlike income taxes, which could be—in fact, theoretically are—levied against the employee who is paying it rather than the payer’s employer, the sales tax must be handled by the merchant, not by the person paying the tax. There is simply no reasonable way for taxpayers to track all of their thousands of inconsequential purchases. Even though they’re the ones paying the tax they are not the ones interacting with the taxing authority, and it’s hard to imagine a workable solution in which they are the ones talking to the taxing authority.

- March 25, 2015: Income tax vs. national sales tax

-

“Taxation without representation”… seen on K Street.

Politicians love hidden taxes. When they raise the taxes on corporations and those corporations raise their prices as a result, the politicians get to preen about the “greedy corporations” instead of looking in the mirror to see who is truly greedy. — Larry J (Economics for Dummies or Presidents (But I Repeat Myself))

I prefer the income tax over the sales tax on the federal level because, conceptually, it’s simple.1 If we are going to have a tax, it must be simple. The things that you are given by your employer are taxable; the only issue comes in determining their worth. And it has to be done once.

A sales tax, however, not so much. Do trade-ins count? Bartering? How do sales prices figure? Yard sales? If yard sales are exempt, what is a yard sale? These are decisions that have to be made several times a week, if not several times over the course of every day. And the more complex or vague, the more you discourage new people from selling: from creating new businesses with new jobs producing new products and keeping prices low.

Because sales taxes are heavily regressive without some additional complication—they will affect people who spend most of their income more than people who spend smaller parts of their income—they almost always come with an additional complication. The national sales tax usually comes with some complex scheme to rebate money to the poor to cover their expected taxes. Why not set a simple, low threshold, below which the tax does not apply? If the tax is so onerous that it would break a person’s wallet, they can choose to break their purchases over multiple days. Families could break up their groceries into multiple carts. But the rich didn’t get rich by wasting their time like that—unless of course the sales tax were so onerous that it became worthwhile to hire people to make smaller purchases for them.

- December 2, 2014: Stephen Colbert’s Christian nation

-

Dear friends who keep posting Stephen Colbert and other quotes about us being a Christian nation meaning we need higher taxes to force everyone to give charitably to the poor and needy:

Most American Christians will tell you that being a Christian nation means we were founded in Christian values, and that this includes, as part of life, liberty, and the pursuit of happiness, the freedom to choose our own Christian duties, the freedom to choose our own charitable acts. The freedom, that is, to choose wrongly as well as rightly; that virtue is no longer virtue when it is forced upon us by the government.

However, you certainly will be able to find Christians who agree with you, who will support your desire to have the government enforce Christian values at the point of the gun. They will happily join you in your crusade to enforce charity at all costs, to teach Christian beliefs at all levels of our government-run schools, to treat conception as the beginning of human life which must be protected at all costs…

This is what you want, right? This is what you’re asking for when you ask us to become a Christian nation by forcing Christian works?

Because that is not a nation I’m looking forward to.

- July 25, 2014: Abolishing the corporate income tax gains steam

-

Abolishing the invisible tax called the corporate income tax has surprisingly gained new supporters since I wrote No corporation pays taxes. Megan McArdle wrote on Bloomberg View that:

The problem with this extended chess game is that every move is very costly. First, it adds to the complexity of the tax code. With every new rule—no matter how earnestly said rule attempts to close a “loophole”—it becomes harder to know whether you are in compliance with the law. This is true on both sides; corporate tax law has now passed well beyond the point where it is possible for a single expert to be familiar with its ins and outs. This makes it harder to plan business expansions, harder to forecast government revenue, and it requires both sides to hire more experts in order to determine whether corporations are compliant. It also means more lawsuits, and longer ones, as both sides wrangle over how this morass of laws should be applied to real-world situations.

The corporate income tax makes it harder to create new businesses because you can’t just become great at making your new widget; you have to become great at understanding and influencing Washington, DC. Which means that many people who would otherwise create thriving new markets with new jobs don’t.

John Steele Gordon at Commentary adds to this, noting:

Megan points out that abolishing the corporate income tax would bring howls of protest from the left that corporations aren’t paying “their fair share.” But corporations, of course, don’t pay the corporate income tax. Instead it’s paid by some combination of workers, with lower wages; customers, with higher prices; and shareholders, with lower profits. The particular combination depends on the economic circumstances of each industry. And abolishing the corporate income tax (which was, anyway, only intended to be a stopgap until a personal income tax amendment could be ratified) would have many extremely positive effects for the American economy.

He goes on to list several benefits of ending the invisible income tax and invisible sales tax that we call the corporate income tax.

And in January, economist Lawrence Kotlikoff wrote in the New York Times that:

- October 23, 2013: Christian values at the point of a gun

-

A relative on Facebook recently posted a scary photo of Jimmy Carter, and the quote:

If you don’t want your tax dollars to help the poor—then stop saying that you want a country based on Christian Values, because you don’t.

Now, if this1 were saying that you should support lower taxes and smaller government so that you can instead give your money to the poor and to Christian organizations that help the poor, I might be able to get behind it. But I am not aware of any place in the New Testament where Jesus says, “you shall force your neighbor by the sword to support government welfare programs rather than private assistance.”

If you want to exhibit Christian values, you share of your own resources. You don’t take the resources of your neighbors and hand them out as if they were your own.

The most famous of Jesus’s samaritans, the Good Samaritan himself, helped on his own dime, not by forcing the innkeeper to give the victim free lodging. It was the priest and the Levite who left the victim to the assistance of government.

There is one place in the bible where Jesus comments on forced giving. In John 12:3-6, John records:

Then took Mary a pound of ointment of spikenard, very costly, and anointed the feet of Jesus, and wiped his feet with her hair: and the house was filled with the odour of the ointment.

Then saith one of his disciples, Judas Iscariot, Simon’s son, which should betray him,

Why was not this ointment sold for three hundred pence, and given to the poor?

This he said, not that he cared for the poor; but because he was a thief, and had the bag, and bare what was put therein.

This is what the bible says forced giving leads to: corruption. Judas, who held the purse, did not want Mary to give to the poor; Judas wanted her to give to him.

Cronyism is rampant in government programs. Just as Judas siphoned from the disciples’ poor box, politicians and bureaucrats siphon from our tax monies to give to those who give back to them.

Jesus talked about this, too. Cronyists have their reward on earth: all of those politicians who rave to us about their programs, and who give to and through those who give back in votes and in campaign funds, are the antithesis of quiet Christian charity. In Matthew 6, Jesus says:

- April 8, 2013: All your income is the government’s

-

If the federal government isn’t eating you, that means it’s subsidizing you! Pray that the mouth doesn’t clamp shut while you’re yanking that tooth.

According to “Martin J. McMahon, Jr., a tax-law professor at the University of Florida”, that which is not taxed is a federal grant. He’s complaining that the free food that Google employees get from Google is paid for by the federal government1:

"I buy my lunch with after-tax dollars," said Mr. McMahon, the University of Florida professor2. "And I have to pay taxes to support free meals for those Google employees."

He wants the IRS to send auditors out to determine the worth of what Google employees eat, because if the government isn’t taxing it, the government must be paying for it. This is the same mentality that says, if the government doesn’t pass laws against it, the government approves it.

It’s utter bullshit. Your taxes are subsidizing lots of crazy things—such as, for example, the University of Florida—but they do not subsidize free meals for Google employees. The money you pay to use Google products—whether directly or through advertisers—pays for free meals for Google employees.

Whether it’s free parking, free lavatory soap and toilet paper, open gyms, or free food, employers provide all sorts of amenities to help keep employees on site. Employees and customers pay for these amenities, through lower wages and higher prices. Some employees use these amenities more than others. It is not a given that these amenities need to be taxed as employee income.

But while it may or may not be right not to count free meals as part of their compensation package, not taxing it doesn’t make it a federal grant—not unless you believe that all incomes are the federal government’s, that federal employees dole out our portion to us according to their whim.

When did the left take over the old Puritan fear that some employee, somewhere, might be having an untaxed good time?

- March 27, 2013: Simplifying taxes into complexity

-

Our taxes are far too complex. Even the Treasury Secretary can’t understand our tax law. Every year about this time, people start writing about solutions to make taxes simpler.

I’m sure this solution has come up before, because it apparently is all the rage in Europe, but this is the first time I’ve seen the recommendation that we keep the tax system incomprehensible and just have our local, state, and federal governments tell us what they think we owe and bill us:

It's already a reality in Denmark, Sweden and Spain. The government-prepared return would estimate your taxes using information your employer and bank already send it. Advocates say tens of millions of taxpayers could use such a system each year, saving them a collective $2 billion and 225 million hours in prep costs and time, according to one estimate.

That’s the response of a dependent mind: Daddy, my taxes are too complicated. Can’t you just tell me what I owe?

The intelligent reaction is, if taxes are too complex and too expensive to calculate, make them simpler.

First, because the obvious next step is for the government to take that “estimate” and withhold it from your paycheck. The mechanism is already there, and they already know what you owe, so why not just keep it? If you think they missed something, you can file an appeal.

But second, because hiding tax calculations just makes cronyism that much easier. Who is for such a plan? Big government proponents such as “Austan Goolsbee, who served as the chief economist for the President's Economic Recovery Advisory Board”. Who is against it? Tax reformers such as “Conservative tax activist Grover Norquist”.1

This proposal violates one of the three bedrocks of fiscally sane taxes: simple, obvious, and unobstructive. By making the tax calculations even less obvious, it becomes easier to engage in cronyism, hiding special tax breaks for political benefactors and hiding special tax barriers for their competition. Making taxes less obvious makes it easier to make them more obstructive.

- February 22, 2012: Vodka Economics

-

It’s nice to every once in a while beat the big guys to the punch. The VodkaPundit “got this fantastic notion this morning, when I remembered an Econ 101 lecture given by Prof. Walter Johnson at Mizzou twenty-mumble years ago” that “corporations don’t pay taxes. Not one red cent. They never have and they never will”.

It’s a brilliant notion: Everyone is brilliant who agrees with me.

Stephen goes on to describe in detail how corporations never pay taxes:

Assume a perfect world—one with no taxes. When you’re done laughing and/or crying, please follow along.

Let’s say Corporation D is smart and lucky enough to show a profit—and in our perfect world, it doesn’t need to form any shelters to dodge any taxes. What does Corp D do with the money? It has several choices, including:

- Hire more workers

- Pay dividends

- Increase pay and/or benefits

- Deposit a rainy day fund

- Invest in expanded production or merger

Now, perfect worlds never last, so let’s say some smart laddie gets himself elected President, sees all that money Corporation D made, and says, “Those greedy corporations need to pay their fair share!” And Congress goes along and imposes a 25% tax on profits. What happens next? That tax gets paid, all right.

It gets paid by the new workers who weren’t hired, by the retirees and mutual funds who got smaller dividend checks, by the employees who didn’t get a pay raise, by the banks who got smaller deposits to loan out, by the entrepreneur who couldn’t get a loan, and it’s paid by each and every one of us, in the form of reduced investment and lower economic growth.

Yes, Corporation D holds the receipt for taxes paid. But the money came out of our hides, not “theirs.”

I’d add (and he includes this in Professor Johnson’s example about rent) that “it gets paid by the people who buy their products and services”.

Corporations don’t pay taxes. Never have, never will. Corporate taxes are an invisible tax on workers and customers. They’re very hard to fight politically; it takes a courageous politician to call for ending this hidden tax; but every tax increase is ultimately paid by you and me: people who earn a wage and people who buy food, gas, and, when possible, fun toys. Every tax increase is ultimately paid for by workers and consumers. Remember that as Obama talks about raising taxes on dividends—or whatever “fair” tax increase he comes up with tomorrow to hide the taxes he wants to levy on you and me.

- October 25, 2011: What’s wrong with a national sales tax?

-

A couple of years ago, the solution to our tax problems was the flat tax; today, the tax savior is the fair tax. The basic difference is that the flat tax is an income tax on all income (except possibly below a poverty threshold) and the fair tax is a national sales tax on all purchases (except possible necessities such as food, or, as in Herman Cain’s 9-9-9 plan, limited only to new purchases).

Is a sales tax better than an income tax? Any tax eventually gets used by the state to try and shape public action, whether to indulge in a bit of cronyism or progressivism. With income taxes, this shaping is limited: it’s very difficult to say that John Smith in Accounting should be taxed higher than Jane Doe the nurse, just because we like nurses more than accountants. We tend to limit our differentiation based on how much money people make, rather than on what job they have.

With a sales tax, however, it’s very easy to say we’re going to tax ice cream more than milk, because we want to discourage people from eating too much ice cream. We already do this all the time. Gasoline has historically had much higher sales taxes than other products in many, if not most, states.1 Cigarettes and liquor are also singled out for special taxes. And we actually have a national sales tax on those products: currently, $1.01 per pack of cigarettes and 18.4 cents per gallon of gas go to the federal government; the liquor tax is more complex. A national sales tax on all purchases will only make this worse: it will be easier to modify taxes for social engineering purposes once all products already have a federal sales tax and all merchants are required to collect a federal sales tax.

This is why I think the best tax is not a tax on individuals, but a tax on states; states will be able to experiment with the best tax regime for the people in their area. Every state can learn from the innovations of their neighbors.

That said, while all taxes have problems, income taxes are probably the fairest tax we can have. Business taxes are hidden taxes on consumers and on employees. Federal sales taxes will inevitably lead to social engineering.2

- September 15, 2011: No corporation pays taxes

-

Congressman Paul Ryan is doing a great job explaining what we need to do to let the economy turn itself around, rather than shackle it to a permanent depression. His videos are simple, honest, and to the point. In his latest, he talks about leveling the corporate tax rate playing field by removing loopholes and lowering the overall rate so that the overall rate is revenue neutral.

I disagree with Ryan’s formulation of the problem, however. He says that some corporations pay taxes; and some corporations pay lobbyists to lobby for loopholes to not pay taxes. In fact, no corporation pays taxes. Some corporations, as Ryan says, choose to hire lobbyists to reduce their tax burdens, thus allowing them to pay higher wages or charge lower prices for their products. Other corporations choose to take the full tax burden and pass that burden on to their customers and their employees.

No corporation pays taxes, because corporations exist to provide goods or services. Every cost that goes into making those goods and services either raises the price of the good/service, or lowers the wages that can be paid to employees. The money has to come from somewhere, and it comes from the cost of what the business sells or how much their employees make. It is the consumer and the employee who pay those taxes. Otherwise, the corporation would go out of business—you can’t sell something for less than it costs to make it, and stay in business. Corporate taxes are an invisible tax on consumers and employees. They are a sneaky sales or income tax increase.

The difference between the two models is, which behavior do we want to encourage? One in which businesses are experts at making some product or providing some service, or one in which businesses are experts in lobbying Washington DC?

Ryan said that: “Every dollar that companies spend lobbying for a better tax deal is a dollar they’re not spending making a better product… We don’t want a tax system that rewards people for coming to Washington and getting special favors.” But his proposal doesn’t fix that. His proposal lowers taxes for those who don’t hire lobbyists, and raises taxes for those who, in the past, did hire lobbyists. In general that’s good, because it is, as he said, fair. It evens the playing field.

- July 3, 2011: How to raise taxes in a Tea Party world

-

I saw a headline on memeorandum today from the New York Times that 2 Republicans Open Door to Increases in Revenue. As is often the case for the Times, the headline didn’t really match the article. The two republicans were Senators John McCain and John Cornyn, but they were clearly “opposed to any tax hikes”. What they’re open to is tax reform, mainly what Republicans like Congressman Paul Ryan have been calling for all along: removing special tax breaks in a revenue neutral manner to simplify our tax laws.

So if it’s revenue neutral, then how does it bring about “increases in revenue” as the headline said? Pretty simple, and it’s also what we did under Reagan: simplifying complex tax codes makes it easier for businesses to make money; when businesses make more money they pay more in taxes. In this context, “revenue neutral” doesn’t mean that the revenue remains the same, it means that the combined tax rate remains the same.

In other words, if the combined rate with the tax breaks is x%, and the tax breaks are removed, the base rate must be reduced by a similar amount so that, all things remaining equal, companies still pay x% and we haven’t lowered or raised taxes by making this change.

Because this is a neutral change, tax revenue won’t go down. But because it simplifies the tax code, profits—and thus the taxes on those profits—are likely to go up. All things haven’t remained equal: we’ve made it easier for companies to focus on their core business (and thus make more money and pay more taxes even though the rates are lower).

Cornyn and McCain did not say they were open to just plain raising taxes. Which is good, because Americans have learned that politicians who combine increased taxes with lower spending can’t be trusted: the tax increases are always real and the spending cuts rarely are. This year’s budget debacle proved it: almost all of the cuts occur in future budgets where they can be removed by future congresses.

If the Democrats (and Republicans) want to raise taxes along with cuts, they need to do so in a way that shows we can trust them: cut this year, and when we can see that the cuts are real and not just accounting tricks, raise temporary taxes next year. As long as the cuts remain real, they’ll have no problem renewing the tax increases year-by-year, because we’ll see that we can trust them.

- Governor Palin’s Seward House Address: Washington, DC Stands In Our Way: Mel at Conservatives 4 Palin

- “There is no ‘value-added’ in any tax.” Governor Palin celebrates Alaska’s 50th anniversary at the (William) Seward House in Auburn, New York. “Girl, are you crazy, the federal government is handing out free money!”

- The Grand Unification Theory of Sucking: Stephen Green at Vodkapundit

- “Let’s pretend for a moment that, god forbid, you break your arm. And somehow you end up with a team of doctors all trained at Obama University. As you lie there on the table in the ER, one doctor treats your arm by banging on the unbroken one with a ball-peen hammer. The second doctor takes the unusual course of setting your hair on fire. And the third one uses leaches. Undeterred by your arm’s stubborn refusal to set, soon the doctors start blaming one another. And even though all of them are doing nothing but compounding your injury, none will take any blame. In fact, the louder you scream, the harder they go to work on you.”

- IRS Urges E-Filing — But by Vendors Only, Please: Martin Kaste

- “In most cases, the companies charge an extra fee for e-filing. In other countries, free and direct electronic filing is a given. But in the United States, Intuit has lobbied hard to make sure taxpayers aren’t allowed to e-file directly to the IRS.”

- Oil Rebounds, Governor Urges Continued Fiscal Restraint: Daniel Terrapin at Conservatives 4 Palin

- “History reminds us that high oil prices are a double-edged sword. The state treasury may swell, but Alaskans will feel the pain at the pump and the pinch of higher energy prices. History also tells us that oil prices go up and down, sometimes dramatically. Now is not the time to grow government. We must be prudent moving forward and exercise fiscal restraint.”

- Tax preparation at Wikipedia

- “The cost of preparing and filing all business and personal tax returns is estimated to be $250-$300 billion each year. According to a 2005 report from the U.S. Government Accountability Office, the efficiency cost of the tax system—the output that is lost over and above the tax itself—is between $240 billion and $600 billion every year. That means Americans spent for preparation roughly 20% of the amount collected in taxes.”

More taxes

- Growth does not pay for itself

- Growth that doesn’t pay for itself is cancerous growth. It isn’t the growth of population that gets more expensive, but the expanding grasp of government.

- Tax me to the church on time

- The left wants to take the policies that are consolidating small businesses into larger ones, and use them to consolidate small churches into larger ones. They want to leverage milker bills and rent-seeking in religion.

- How did Donald Trump qualify for a middle-class tax break?

- Trump qualifies for tax breaks because we have a complex tax system that encourages anyone who can afford to, to hire tax lawyers. Big government needs a complex tax system to survive.

- Income tax vs. national sales tax

- There is no such thing as a fair tax. All we can do is try for the simplest, most unobstructive tax we can find.

- Twelve cookies on a plate

- There are twelve cookies on a plate. The left says that they can feed the poor by taking that rich guy’s cookies away, and leaving yours alone.

- 26 more pages with the topic taxes, and other related pages