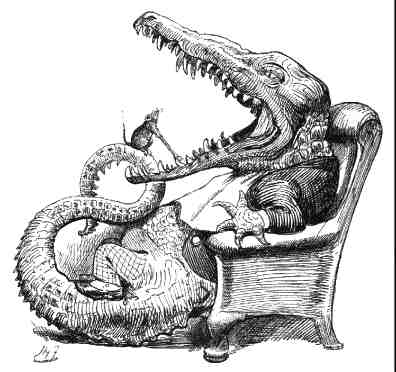

All your income is the government’s

If the federal government isn’t eating you, that means it’s subsidizing you! Pray that the mouth doesn’t clamp shut while you’re yanking that tooth.

According to “Martin J. McMahon, Jr., a tax-law professor at the University of Florida”, that which is not taxed is a federal grant. He’s complaining that the free food that Google employees get from Google is paid for by the federal government1:

"I buy my lunch with after-tax dollars," said Mr. McMahon, the University of Florida professor2. "And I have to pay taxes to support free meals for those Google employees."

He wants the IRS to send auditors out to determine the worth of what Google employees eat, because if the government isn’t taxing it, the government must be paying for it. This is the same mentality that says, if the government doesn’t pass laws against it, the government approves it.

It’s utter bullshit. Your taxes are subsidizing lots of crazy things—such as, for example, the University of Florida—but they do not subsidize free meals for Google employees. The money you pay to use Google products—whether directly or through advertisers—pays for free meals for Google employees.

Whether it’s free parking, free lavatory soap and toilet paper, open gyms, or free food, employers provide all sorts of amenities to help keep employees on site. Employees and customers pay for these amenities, through lower wages and higher prices. Some employees use these amenities more than others. It is not a given that these amenities need to be taxed as employee income.

But while it may or may not be right not to count free meals as part of their compensation package, not taxing it doesn’t make it a federal grant—not unless you believe that all incomes are the federal government’s, that federal employees dole out our portion to us according to their whim.

When did the left take over the old Puritan fear that some employee, somewhere, might be having an untaxed good time?

In response to No corporation pays taxes: Corporations don’t pay taxes. Their employees do, and their customers do. Every dollar that a company has to pay in taxes, that company must pass on to either their employees or their customers, if the company wants to stay in business.

I’m assuming here that he isn’t complaining that Florida State taxes are sent to Silicon Valley to pay for Google lunches.

↑And past IRS employee (Professor-in-Residence, Office of Chief Counse, 1986-1987) but that’s not mentioned in the article.

↑

- Silicon Valley’s Mouthwatering Tax Break: Mark Maremont

- “Debate Emerges Over Whether Daily Fringe-Benefit Meals Are Taxable; Issue Is Now on IRS’s Radar” (Techmeme thread)

- UF research funding hits $644.4 million in 2012, surpassing non-stimulus record

- “Research awards to University of Florida faculty totaled $644.4 million in 2012, a $25 million increase over 2011… two-thirds of the funding, or $423 million, came from federal agencies… funding from the National Science Foundation rose to $53 million, a 20 percent increase over 2011. The U.S. Department of Energy awarded the university $20 million, a nearly 43 percent increase over 2011’s $14 million.”