Government oxymoron: anti-corruption laws

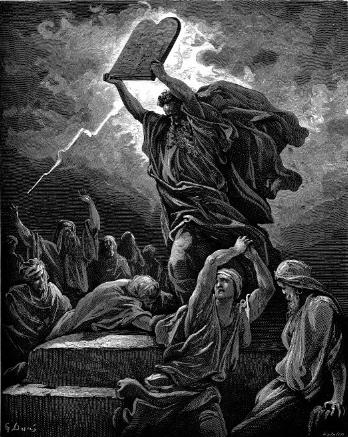

There’s a lot to be said for chiseling laws in stone by hand rather than typing them at high speed on a word processor.

In the latest Weekly Standard, Jay Cost asks, So, what about money in politics?, taking Republicans to task for twiddling their thumbs while Democrats rant about Citizens United. He concludes that while the Democrats have enacted self-serving reforms that ban things they don’t use and exempt the corruption they rely on, conservatives shouldn’t just make fun of their hypocrisy nor rail against their counter-productive, corruption-causing laws. To win the minds of the public, conservatives “must promote ideas to constrain influence-peddling in politics, and then pressure the ever recalcitrant GOP to enact those reforms into law.”

Now, on the one hand, he’s right. When one person is doing something that makes matters worse, and another person is arguing against doing something because it is just making matters worse, there is a strong tendency in the modern world to side with the person who is at least acting.

But from the standpoint of actually reducing corruption rather than increasing it, he’s wrong—as described in an earlier article in the same issue, where Stephen Moore argues for simplifying the tax code because layer upon layer of laws “mostly benefit the wealthy and politically well-connected.”

The only people who benefit from a complicated, barnacle-encrusted 70,000-page tax code are tax attorneys, accountants, lobbyists, IRS agents, and politicians who use the tax code as a way to buy and sell favors. The belly of the beast of corruption in American politics is the IRS tax code. — Stephen Moore (Remember the Flat Tax?)

We’ve long passed the point where adding laws can have a beneficial effect; the problem is that our laws are so complex that only the wealthy and well-connected can understand them, and because of this they get to manipulate them. Get rid of the complexity and “D.C. becomes the Sahara Desert.”

This is hardly news. The philosopher Lao Zi described the process millennia ago when he wrote that:

The more the ruler imposes laws and prohibitions on his people, the more frequently evil deeds would occur. — Lao Zi (The Silence of the Wise: The Sayings of Lao Zi•)

Corruption comes when people in the government have power and others wish to buy that power. The more complex the laws, the more power people in the government have to choose how to interpret, implement, and modify them.

When someone in government is given power to choose what political speech is allowed, that person—and that government—are subject to more corruption than otherwise.

The best anti-corruption law is to repeal the laws and complexity that encourage corruption.

We can only be rid of loopholes by simplifying; complexification only adds loopholes.

Because taxes are a direct transfer of money to government, they attract corruption among those who can afford to influence the tax law. The low-hanging fruit of anti-corruption reform is to simplify the tax code. But this is low-hanging fruit only in how technically easy and effective it would be. Few politicians are going to have the fortitude and communication skills necessary to explain that the very best and easiest step we can take toward reducing corruption would be to get rid of the hidden taxes on income and purchasing that is the corporate income tax.

In response to Essential Revolution: The Return of the Republicans: The crime of the day is when you do it again.

- The Bureaucracy Event Horizon

- Government bureaucracy is the ultimate broken window.

- No corporation pays taxes

- Corporations don’t pay taxes. Their employees do, and their customers do. Every dollar that a company has to pay in taxes, that company must pass on to either their employees or their customers, if the company wants to stay in business.

- Remember the Flat Tax?: Stephen Moore at The Weekly Standard

- “It’s still a good idea.” (Memeorandum thread)

- So, What About Money in Politics?: Jay Cost at The Weekly Standard

- “While Democrats decry Citizens United, Republicans twiddle their thumbs.”

- Tax individuals, not organizations

- Taxes on businesses are just a way of hiding taxes so that people don’t know they’re being taxed.

More corporate cronyism

- Business prospect incentives discourage innovation

- Complicating the law and raising taxes, then lowering them for businesses that know how to lobby local or state governments, is not a recipe for encouraging innovation. It is a recipe for killing it.

- Atlas Shrugged II: The Strike

- I just saw the second part of the Atlas Shrugged trilogy. It is amazing.

- Crony vs. Crony

- The voters will look up and shout “save us!” History will look down, and whisper “no”.

- Why is the media saying Sanders lost the debate?

- Bernie Sanders spoke an important and inconvenient truth about socialism when he came to Hillary Clinton’s defense at the debates.

- The Parable of the Primary

- If Republicans are looking to be more Obama than Obama, they couldn’t have found a better cronyist than Donald Trump.

- 15 more pages with the topic corporate cronyism, and other related pages

More corruption

- A tale of two negotiators

- If you want to see how Republicans in Congress fail to pass successful reforms, compare the House Obamacare “repeal” with the White House’s budget.

- Stop the rot—with sunlight and sunset

- If reform conservatism needs an anticorruption agenda, what structural changes should be on that agenda?

- Essential revolution: fight corruption

- The only sure means of fighting corruption is to take away the powers that invite it.

- Pennsylvania AG says crime is racist

- Pennsylvania Attorney General vows to stop investigating and prosecuting crimes. “We know most blacks commit crimes, so it’s racist to target criminals for prosecution.”

- Throw Them All Out

- IPO nowadays stands for Invest in Politicians Often. Investing in politicians brings huge returns.