The Family Cow

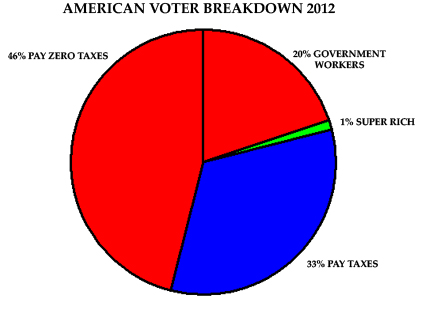

When the government worker slice of the pie gets bigger than the private worker slice, look out. (From the California Public Policy Center)

You have a family of seven, with another on the way. You feed your family on the milk from your single cow. As your family grows, that milk is leaving you hungrier and hungrier and you’re starting to dream of thick, juicy steaks.

Do you kill the cow and eat well this week, knowing it dooms your family next week?

This is a trick question. Of course, you don’t kill the cow. It may hurt now to go without the meat, but there’s a mathematical certainty of doom once the milk stops flowing. It’s really a trick question: the trick answer is, why are you relying on the cow? Why aren’t you and your oldest kids doing some work too? That cow is eventually going to die, leaving you with no food at all, not even milk.

We cannot rely on a shrinking tax base of employed—the rich and the middle-class—to pay for the growing population of government workers1, subsidized workers, and an increasingly wealthy underclass.

Nor can we start killing them by taking their savings and property to pay for government programs. It might make a tasty steak once, but when that steak is gone there’s nothing to replace it. Who will want to make money (and thus pay their milk in taxes) when even the money they get to keep ends up on the table? Who are you going to sell to when potential buyers know you’ll just take it back when your resources run dry next year?

Doom is a mathematical certainty when you kill the cow.

In response to The Parable of the Mexican Farmer: Betsey Stevenson’s an example of why it’s so hard to create middle-class jobs, Jared Bernstein.

It’s important to remember that for all practical purposes, government workers do not pay taxes. Their salaries come from the money that the government collects as taxes from the private sector. Then they return a fraction of their wages back to the government. But it would make no difference to the government’s finances if, for example, a government worker who pays 30% in taxes were instead to pay no taxes and just have their income reduced by 30%.

It would make a huge difference to government finances if private-sector workers paid no taxes.

↑

- America’s Atlas Generation—The Forgotten 33%

- “While the government worker union spokespersons want us to believe that Wall Street is trying to divide and conquer the middle class by pitting private sector workers against government workers, the truth is this: Government workers have joined with Wall Street and turned against the private sector taxpayers, because it is in their mutual economic interests to do so.”

- Fred Thompson endorses Newt Gingrich on ‘Hannity’: Sean Hannity

- “Even these numbers that are coming out of Washington that look so bleak are understated. They are based on false projections of growth and things of that nature. We have historically low interest rates, and when they start to come up as the largest debtor in the world, we’re going to be in an additional fix that we can’t bail ourselves out of.” “I think we’re at a tipping point in this country. I think there are going to be more people in the wagons soon than are pulling the wagon.”

More balanced budget

- Congress passes sound budget

- Today’s fiscally-sound budget is a compromise between the left-of-center Ryan roadmap and the right-of-center Rand proposal.

More government spending

- Othering reduced spending

- Reducing spending to match revenue is less of an answer than pretending the problem doesn’t exist.

- Why “we don’t have a plan” is selfishly incompetent

- The Obama White House tells congress, “we don’t have a plan, but we don’t like your plan” when confronted with the destruction of the United States economy by 2027. Why can’t we continue to live large and then fix the problem in 2027?

- Ryan: End oil subsidies?

- Of course we want to end oil subsidies. Maintaining oil subsidies because gas prices might rise is crazy: we pay for those subsidies, too!

More public assistance

- How many legs does the ACA have?

- If you call public assistance insurance, how many people have insurance? The left wants us to believe that, like Lincoln’s apocryphal dog, the ACA has five legs. But when you call a tail a leg, that doesn’t mean the dog can walk on it.

- A grumpy basic income

- John Cochrane has useful thoughts on Charles Murray’s universal basic income, after the Swiss rejected a very different version.

- Government cheese goes to school

- Government cheese is government cheese, whether it’s a poor food product, poor housing, or poor education.

- Everybody gets $7,000 a year

- Charles Murray argues that we can vastly reduce the cost of the welfare system and social security simply by giving everyone $7,000 a year plus a health plan.

- Social Security reform and the polls

- Republican efforts on social security reform may pay off even if polls indicate people don’t currently support reform.

- Two more pages with the topic public assistance, and other related pages

“There are going to be more people on the wagon, soon, than are pulling the wagon.”—Senator Fred Thompson